Table of Contents

A report released by the Tax Foundation on Thursday noted that when it comes to sports betting taxes in the US, the policies vary significantly by state.

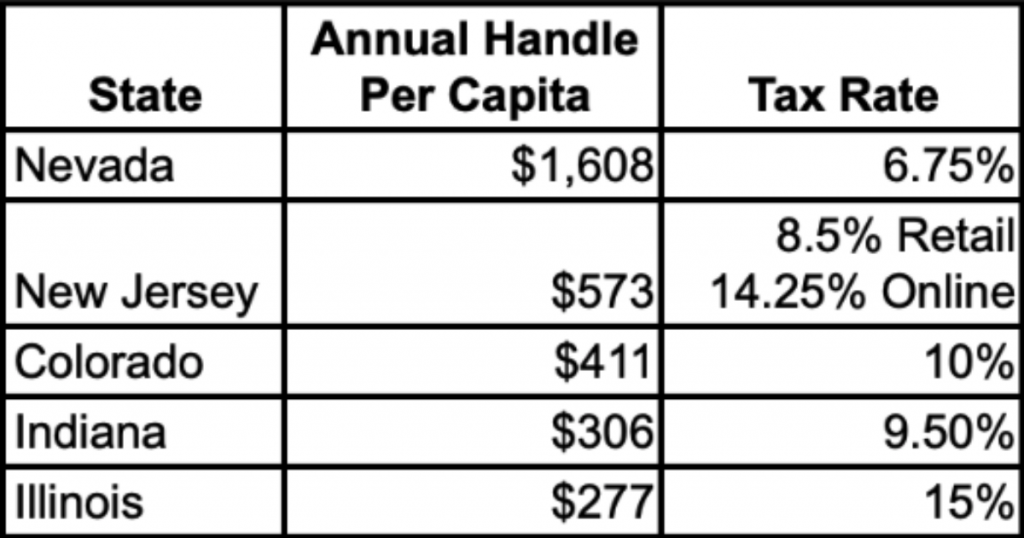

De study looked at 18 states where sports betting is currently offered. In four of those states – Colorado, Michigan, Pennsylvania, and Virginia – it found that the effective tax rate was drastically lower than the statutory rate. In some cases, the effective rate was less than half the statutory rate.

Those four states all allowed sports betting operators to deduct promotional costs, such as deposit bonuses and free bets, to lower their liability.

Colorado, Pennsylvania, and Virginia also allow operators to deduct the Federal Excise Tax. In addition, Virginia even allows deductions for losses. Senior Policy Analyst Ulrik Boesen wrote that it can be a challenge to forecast revenues when operators can take such deductions.

In Colorado, voters approved a sports betting referendum in 2019 with the purpose of funding the state’s Water Plan. Boesen noted that state officials estimated the state would collect an average of $16 million annually from the tax for the first five years. However, between May 2020 to April 2021, the state received just $6.6 million.

States that do levy a tax with deductions should consider some cap if the tax is supposed to raise revenue for dedicated spending,” Boesen wrote. “Without a cap, sports betting operators could theoretically eliminate their tax liability completely, and it does not necessarily impact proceeds.”

Colorado, which has a 10 percent rate, has an effective rate of 4.47 percent, according to the study. Michigan, which has an 8.4 percent rate, has an effective rate of 3.28 percent. Pennsylvania taxes sports betting operators at 36 percent, but the deductions make the effective rate 25.4 percent. Virginia’s 15 percent rate becomes an effective rate of 5.14 percent after deductions.

Lower Tax Rate May Boost Betting

According to the American Gaming Association, 21 states and the District of Columbia currently allow sports betting. Two of those states – New Mexico and North Carolina – allow it only at tribal casinos. In addition, 10 more states have legalized sports betting, but sportsbooks are not operational in those locations yet.

For those states that have yet to pass legislation but are considering it, Boesen said lawmakers should pay attention to how the tax policy is working in other states.

He also did not call for states to levy high taxes on sportsbook revenues.

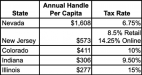

“(S)tates with a low tax burden may generate more economic activity,” he said. “The five states with the highest handle per capita all have relatively low tax rates.”

Federal Sports Betting Tax Antiquated

Boesen added that it’s rare to permit deductions of a federal excise tax for a state’s excise tax. However, he said that the states allowing it for sports betting may be taking the right step.

“The federal tax on sports betting is both outdated and flawed in its design, so the chance of a successful betting market increases with this deduction,” he said.

The federal excise tax, established in 1951, charges licensed sportsbooks a .25 percent levy on each wager. The tax was meant to help fund the effort to deter illegal sports betting. However, its critics note it’s a cost illegal bookmarkers do not have to pay. That makes their lines more attractive.

The American Association has made eliminating the tax one of its agenda items for Congress.

Earlier this year, US Reps. Dina Titus (D-Nevada) and Guy Reschenthaler (R-Pennsylvania) filed a bill to repeal the excise tax. It’s the second straight year the co-chairs of the Congressional Gaming Caucus have sponsored the measure.

The post Study Reveals Allowable Deductions Impact Sports Betting Tax Receipts appeared first on Casino.org.